Life Insurance in and around Norwalk

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

It can be a big responsibility to provide for your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that those closest to you can maintain a current standard of living and/or pay off debts as they mourn your loss.

Life goes on. State Farm can help cover it

What are you waiting for?

Put Those Worries To Rest

You’ll get that and more with State Farm life insurance. State Farm has fantastic policy choices to keep your family members safe with a policy that’s modified to fit your specific needs. Luckily you won’t have to figure that out by yourself. With personal attention and excellent customer service, State Farm Agent Frank Fraulo walks you through every step to create a policy that safeguards your loved ones and everything you’ve planned for them.

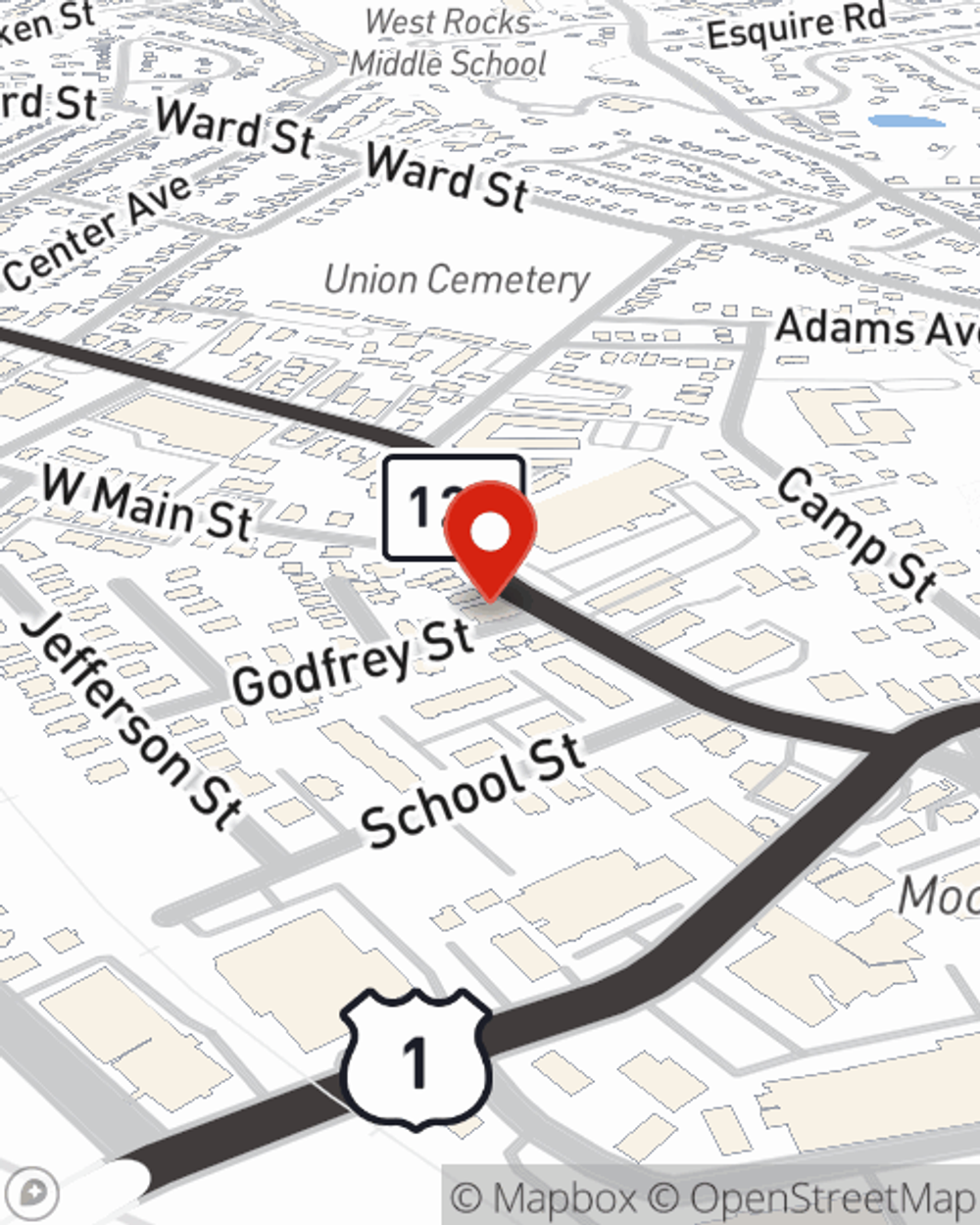

Interested in checking out what State Farm can do for you? Contact agent Frank Fraulo today to get to know your unique Life insurance options.

Have More Questions About Life Insurance?

Call Frank at (203) 454-3400 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Frank Fraulo

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.